Toronto, 7 September 2023 – Accelex, a leading technology provider of alternative investment data acquisition, reporting and analytics, is announcing its strategic partnership with FINARCH, a digital transformation partner for leading Asset Managers and Institutional Investors with deep expertise in advanced financial software solutions. This collaboration marks a significant milestone in the pursuit of operational excellence and enhanced efficiency for organizations operating in the private markets.

As private markets continue to evolve and expand globally, the need for digital transformation with sophisticated technology solutions has become paramount. FINARCH brings extensive experience in advising and implementing advanced financial software solutions, making them an ideal partner for Accelex. Their commitment to innovation, coupled with a deep understanding of the unique challenges faced by institutional investors, aligns seamlessly with Accelex’s vision and goals.

Through this partnership, Accelex and FINARCH will combine their respective expertise to optimize and streamline the implementation process. Their close collaboration will revolutionize the way firms in private markets operate, providing a comprehensive suite of solutions, including portfolio monitoring, performance analytics, compliance management, and data integration.

“We are thrilled to announce our partnership with FINARCH,” said Kevin Jennings, Sales Director at Accelex. “Their deep knowledge of financial software solutions combined with our innovative technology platforms will enable us to deliver unparalleled value to organizations operating in private markets. Together, we will revolutionize the industry and empower firms to achieve operational excellence, make data-driven decisions, and drive sustainable growth.”

“We are excited about partnering with Accelex,” said Edward Wong, Director at FINARCH. “This collaboration brings together the best of our expertise and technologies, allowing us to create a transformative impact for firms operating in the private markets. Together, we will empower our clients with innovative tools and insights to navigate market complexities, seize opportunities, and drive operational efficiency.”

About Accelex

Founded in 2018, Accelex provides data acquisition, analytics and reporting solutions for alternative investors and asset servicers, enabling firms to access the full potential of critical investment performance and transaction data. Powered by proprietary artificial intelligence and machine learning techniques, Accelex solutions automate processes for extraction, analysis and sharing of difficult-to-access unstructured data. Accelex is headquartered in London, with offices in Paris, Luxembourg, New York, and Toronto. www.accelextech.com

About FINARCH

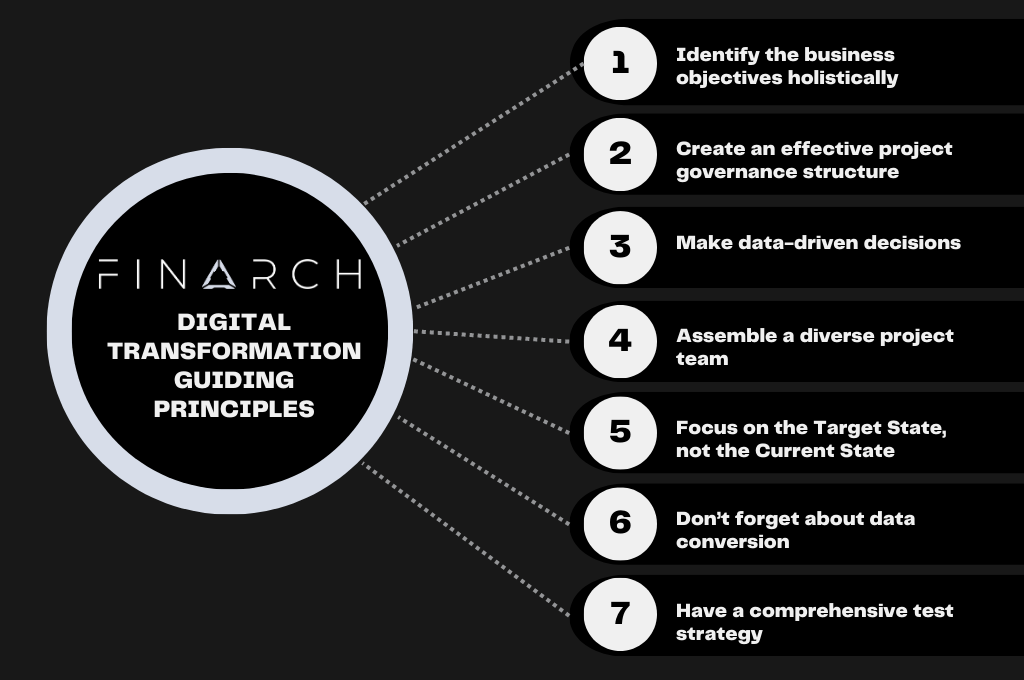

Established in 2016, and rebranded in 2022, FINARCH is a digital transformation partner for leading asset managers and financial institutions. Through their collaborative partnership approach, FINARCH leads organizations on a journey towards digital excellence. By working closely with their clients as implementation partners, FINARCH provides best-fit solutions that optimize operations and enhance the efficiency of people and processes. FINARCH is headquartered in Singapore, with offices in Canada and the US. www.finarch.ai

Media Contacts

Frank Chatzigeorgiou – Accelex

frank.chatzigeorgiou@accelextech.com

Edward Wong – FINARCH

Edward.Wong@finarchglobal.com