Canadian Pension Fund

Large digital transformation project for Canadian Pension Fund. FINARCH team had Lead roles in several workstreams and provided executive advisory and strategy to ensure a successful go-live

We work with some of the leading Asset Managers to help achieve their digital transformation ambitions.

At FINARCH, we guide organizations through their digital transformation journey. Working collaboratively as implementation partners, FINARCH can help achieve your business vision to enable best fit solutions, streamlined operations and more efficient people and processes.

FINARCH was born with a mission to do consulting better.

Digital transformation is a daunting task – even for well-run and established organizations. Often it completely changes the processes, technology and human resources that have been running your business for decades. It requires a completely different mindset, approach and tenacity to implement successfully. Digital transformation within the capital markets and alternative investments is often even more challenging due to the legacy nature of most systems and complicated business processes.

At FINARCH, we have helped our clients implement even the boldest of digital transformation projects. We bring decades of experience and a pragmatic view to help guide our clients on their digital transformation journey.

We take a pragmatic, vendor agnostic approach to advising and crafting solutions for your organization.

We utilize a client-oriented and delivery first mindset. Instead of aggressive sales tactics, we prefer to grow our business organically through referrals and only take new work when we are confident we can deliver and exceed our clients demanding expectations.

We understand technology is the driving force of all digital transformation projects, and we have integrated that expertise into our core capabilities.

We combine our technical expertise with our deep specialization in capital markets and alternative investments to deliver best-fit solutions for our clients.

We have a razor sharp focus on what we do best – which is capital markets and investment management systems implementation, support and selection.

We specialize in working with the leading software used in the investment management industry. We move in parallel with the rapid evolution of the capital markets by constantly learning and enhancing our capabilities.

We do consulting differently.

Despite being eager to tell clients how much their industries are evolving and that they need to invest in their services, the reality is most consultancies have operated with the same business model for decades. They use a sales first mentality and their business models consists of putting as many bodies as possible on their engagements to maximize revenue.

At FINARCH, we think this approach is dated and have an alternative value proposition to our clients.

See how we stack up against Traditional Consultancies below:

We work with some of the leading investment managers

Large digital transformation project for Canadian Pension Fund. FINARCH team had Lead roles in several workstreams and provided executive advisory and strategy to ensure a successful go-live

Large multi-year 100m+ digital transformation project to implement SimCorp Dimension, Bloomberg AIM, and new Enterprise data lake/reporting hub.

Singapore asset manager with multi year front-to-back SimCorp Dimension implementation. FINARCH provided subject matter expertise and workstream leadership across several domains.

Target Operating Models aims to outline the desired allocation of resources to achieve critical business functions. However, rigidly implementing a Target Operating Model can be costly and time-consuming for organizations. Flexible and iterative optimization unlocks potential and provides competitive advantages in dynamic markets.

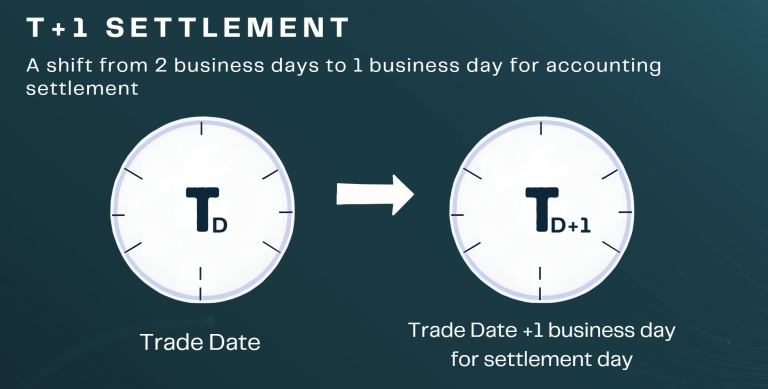

The speed required for efficient reconciliation to support a one day settlement period is pushing firms’ reconciliation capabilities to their limits.

This article highlights the opportunities and challenges faced by asset managers when implementing artificial intelligence within their organizations.