The rapid and efficient exchange of information is arguably one of the most important competitive advantages in the asset management field, for a very simple reason: the performance of industry players essentially relies on the quality of their decision-making.

The available information obviously allows, on the one hand, the analysis for investment decisions, but also meeting the increasing levels of regulatory requirements that the industry is now facing which, involves continuously higher quality standards.

Due to the nature of its activities, the asset management industry could be considered at the forefront in terms of data management and administration. Therefore, some people say that the industry is ‘’digital native’’. Therefore, Financial institutions have indeed been benefiting from significant digital infrastructures for several years, upon which almost all their operations depend today.

However, recent progress, particularly related to artificial intelligence, has raised higher requirements regarding the quantity and quality of information to be collected and managed in order to fully capitalize on the potential of these new technologies.

In this sense, some catching up might be necessary for many, who would not want to lag behind this significant movement. The objective of this text is to highlight the opportunities brought by the advent of artificial intelligence as well as the key success factors related to the corporate data management framework that will allow successful integration of this technology within a given company.

Opportunities related to the exploitation of artificial intelligence within the capital markets

The Increasing Popularity of AI

Even the most technophobic individuals will recognize that AI is currently the topic of the hour. Since the advent of generative AI, not a day goes by without this technology making headlines.

Many hopes are attached on this technical progress, perceived by some as one of the greatest scientific advancements in our modern history. Some more skeptical individuals see in this sudden enthusiasm traces of a potential speculative bubble. They support their argument notably by the upheavals experienced by the technology sector in the early 2000s with the democratization of the web and the advent of e-commerce.

For our part, and with all due reservations, we believe that the importance of recent investments, prompted by the importance of enthusiasm, supported by the commercial successes that have been observed justifies taking it seriously. In other words, beyond knowing whether these benefits will be effective or whether it is just a passing trend, it is important to develop a plan to potentially take advantage of this significant movement, at least to be ready. In our opinion, to ignore a phenomenon of this magnitude completely would be to take an unjustified risk.

The advent of AI (and generative AI) generates numerous opportunities that will most likely transform into a competitive advantage, or even potentially a survival criterion, for some players in our industry. Among these opportunities, we think in particular of the following elements:

- The possibility of collecting a greater amount of data to optimize the decision-making process

- Automation opportunities

- Evolution from robotization to full delegation to an autonomous system

Ability to process a larger inventory of data

The main advantage of AI is to allow us to take advantage of significantly broader informational scope, which would otherwise be impossible to handle by an individual. This notably accelerates decision-making while maintaining (or improving) the risk posture.

Activities purely related to quantitative analysis such as the selection of securities should, for all practical purposes, be delegated (completely) to the machine to allow portfolio managers to focus on activities where human intervention remains valuable, such as risk assessment and market trend analysis.

The idea is not so much to advance that all analysis activities should be delegated to machines (although this would be conceptually possible), but rather to emphasize activities where human intervention remains critical.

Since market evolution does not follow a linear trajectory and reactions do not always correspond to predictions based on historical models, human intervention remains essential. It would also be risky to rely solely on machine recommendations, as it cannot interpret unforeseeable events, such as force majeure cases, which could not have been considered during the development of conventional models.

Although this may be considered part of the “learning” exercise targeted by the approach, potential errors in parameter setting or distortions caused by poor data sampling should also be considered to avoid unnecessarily increasing the risk associated with a hasty and ambitious adoption of this relatively new technology.

In short, due to the increasingly large amount of data to be considered by asset managers and the growing diversity of their activities, we believe it will be opportune, even essential, to make good use of emerging technologies to support decision-making to meet the increasing requirements for speed in decision-making. The implementation of intelligent systems adapted to the specific realities of users will be, in our opinion, indispensable in the medium/long term.

Automation of low-value-added tasks

It remains surprising to this day to note, in an industry as highly digitalized as finance, the still systematic uses manual to processes and human interventions. Not only are such method very costly in terms of resources, they also entail a significant risk of processing errors, giving rise to significant quality issues within the operational chain. The opportunity associated with automation is quite straightforward. The idea is to allow constant growth of supported activities, while keeping stable the resources to be engaged to support them.

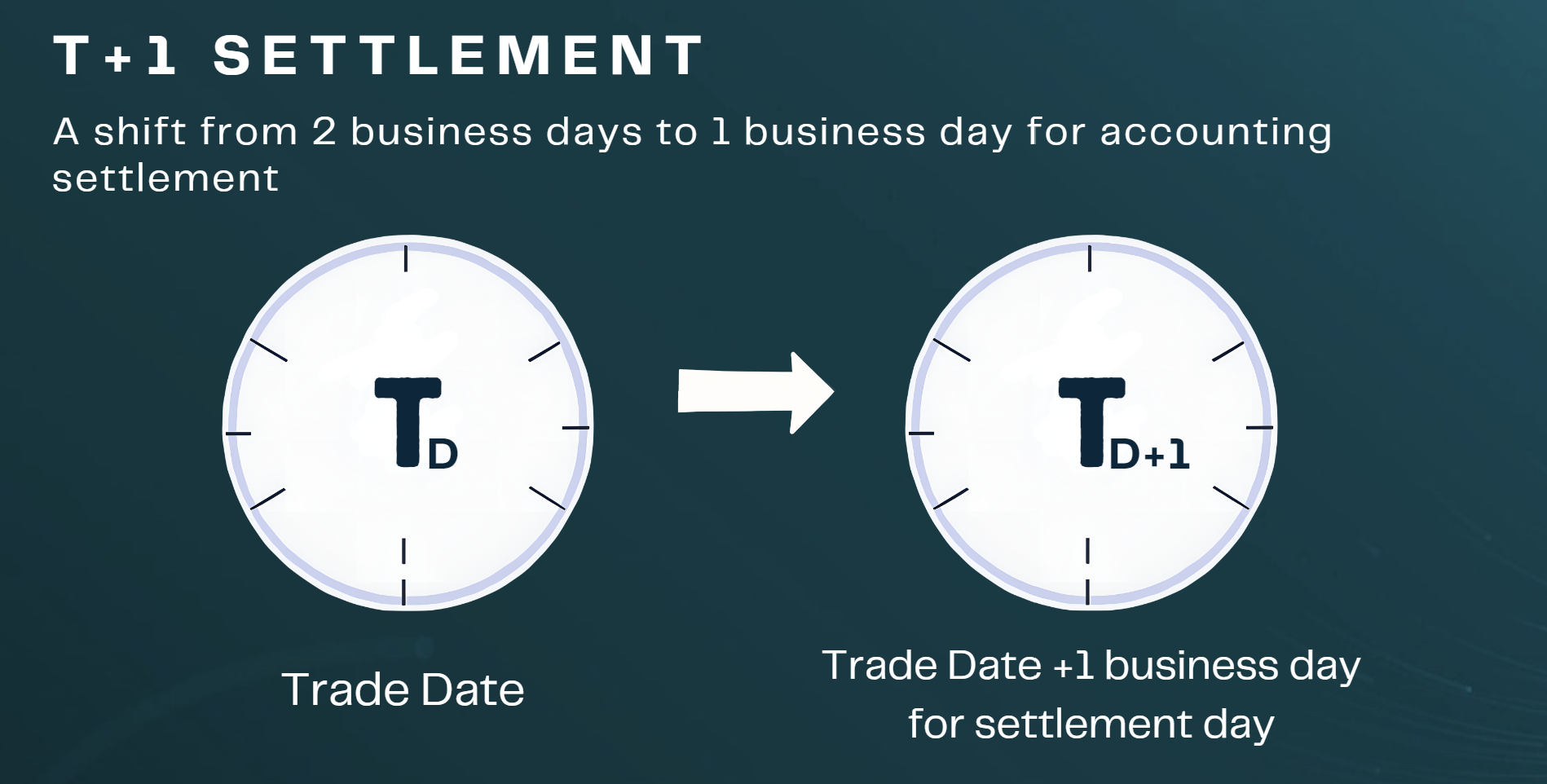

Automation opportunities abound in buy-side finance, primarily at the back and middle office space. Whether it is settlement of transactions, the various reconciliations required, or actions to be taken following certain market events, everyone will agree that assigning these tasks to an automated system would be desirable.

Evolution from robotization to full delegation to an autonomous system

However, when it comes to automation, it is important not to confuse robotization with the use of more modern techniques based on artificial intelligence. Robotization mainly addresses tasks of a static and predictable nature. Artificial intelligence, on the other hand, allows for the interpretation of the various possible scenarios in the processing of the same task and the application of the appropriate treatment. This interpretation can evolve depending on context variations that depend either on the advent of new scenarios, or on a wider data domain allowing for finer analysis.

Understanding this fundamental difference is important in order to properly measure the value proposition of artificial intelligence. Indeed, the use of automation is certainly not new. A still significant proportion of what is displayed as AI today is nothing new and can be associated with statistical or econometric modeling techniques that have been common practice for several years.

What is different today is not so much the theoretical foundations of the techniques used, but rather the capacity and performance of the systems used to collect and process an ever-increasing amount of data. These two approaches should not be seen as contradictory, but rather as one being the linear evolution of the other.

Typical algorithmic flaws, such as design deficiencies, lack of adaptability to a changing context, or the simple difficulty of choosing the algorithm that will best adapt to a given context, are all elements that artificial intelligence can help overcome by adding an additional layer of assistance.

Challenges associated with the adoption of AI for asset managers

Although the financial industry is considered a pioneer in the digital world, the adoption of Artificial Intelligence by its players still comes with a certain set of challenges. Among the many challenges that could slow down the adoption of this technology, we have chosen to focus more particularly on the following:

- Use of obsolete systems or platforms that need to be changed or modernized to support contemporary business practices.

- Lack of integration between different systems to ensure adequate data sharing between different business functions

- Absence or insufficiency of a centralized infrastructure dedicated to corporate data management

- Difficulty in recruiting the expertise necessary to carry out projects and ensure the operational maintenance of tools

- Lack of internal processes to ensure healthy corporate data governance to ensure its quality and integrity.

Obsolescence of existing tools

It frequently happens that asset managers maintain platforms and tools that are sometimes outdated in terms of standards and modern practices. This situation is explained in part by the fact that these central tools have often been modified to adapt to the operational realities specific to their users. On the other hand, the motivations for making such an important change are often perceived as insufficient compared to the tangible benefits it could bring. However, the use of outdated (and often highly personalized) systems can be an obstacle to the adoption of AI due to the complexity of integration, data compatibility issues, performance limitations, security risks, resistance to change, and potential lack of supplier support.

Lack of integration between different systems

Data sharing between systems undoubtedly brings value but proves to be costly to implement and maintain. Consequently, it often happens that, in the absence of prior integration efforts, the data cannot be made available to be used as an input for an AI powered system. The consequence of such a situation is that it tends to increase the costs of adoption and operation of such platform

Absence or insufficiency of a centralized infrastructure

Single integration is not sufficient to allow the use of data according to the required quality standards. This collected data must also be centralized to harmonize the different formats and structures proposed by source systems.

To achieve this, the use of a centralized environment enables data to be homogenized and accessed in sufficient numbers to build AI solutions whose reliability will not be jeopardized by the availability of poor-quality data.

Scarcity of specialized workforce

The current enthusiasm for AI-related technologies is leading to massive investments and, therefore, an unprecedented demand for qualified workforce in this field. It is therefore difficult for some companies to attract and retain the talents necessary for the development of internal tools. This situation certainly contributes to the delay taken by some players in modernizing the infrastructures required to exploit these new technologies.

Absence of an internal governance framework for data management

It is through data governance that we manage issues of availability, usability, integrity, and security of internal data. Defining internal processes and standards adapted to the realities of the company concerned is essential to ensure the required control in the healthy management of risks (both regulatory and operational).

In the specific context of AI, such a mechanism is essential to provide increased monitoring of the quality of outputs. Moreover, it should be expected that this technology will be subject to increasingly strict regulations over time, which argues in favor of developing a clear decision-making mechanism.

Conclusion

As mentioned above, the current enthusiasm and the importance of investments in technologies associated with artificial intelligence are sufficient to think that it is a lasting trend. Consequently, institutions that follow suit quickly will have the best chance of being able to capitalize on what will certainly be an important competitive advantage, or even vital in the years to come.

However, the full use of this type of technology in current operations will depend heavily on the maturity level of organizations in managing and governing their corporate data.

At this stage we believe that there is still a lot of work to be done to put in place winning conditions. The various observations we have had the opportunity to make during our last mandates tends to confirm (on our scale, obviously) that the overall maturity level of companies in terms of managing and framing data is still generally insufficient.

To rectify the situation, we believe that significant investments will be necessary to correct the essential foundations for implementing processes supported by artificial intelligence, or at least for this technology to be able to act to its full potential.