Bridging Opportunity and Challenge: Navigating AI Integration in Asset Management

This article highlights the opportunities and challenges faced by asset managers when implementing artificial intelligence within their organizations.

This article highlights the opportunities and challenges faced by asset managers when implementing artificial intelligence within their organizations.

Accelex, a leading technology provider of alternative investment data acquisition, reporting and analytics, is announcing its strategic partnership with FINARCH, a digital transformation partner for leading Asset Managers and Institutional Investors with deep expertise in advanced financial software solutions. This collaboration marks a significant milestone in the pursuit of operational excellence and enhanced efficiency for organizations operating in the private markets.

Within the capital markets and specifically buy-side firms, there are only a handful of systems used across the industry globally. Within these vendors, most claim to offer Cloud-based technology and solutions, but how true is it?

In this article, we will discuss the differences between Cloud-enabled and Cloud-native solutions and how Cloud-washed solutions will impact your implementation timelines, on-going (BAU) costs, and support model.

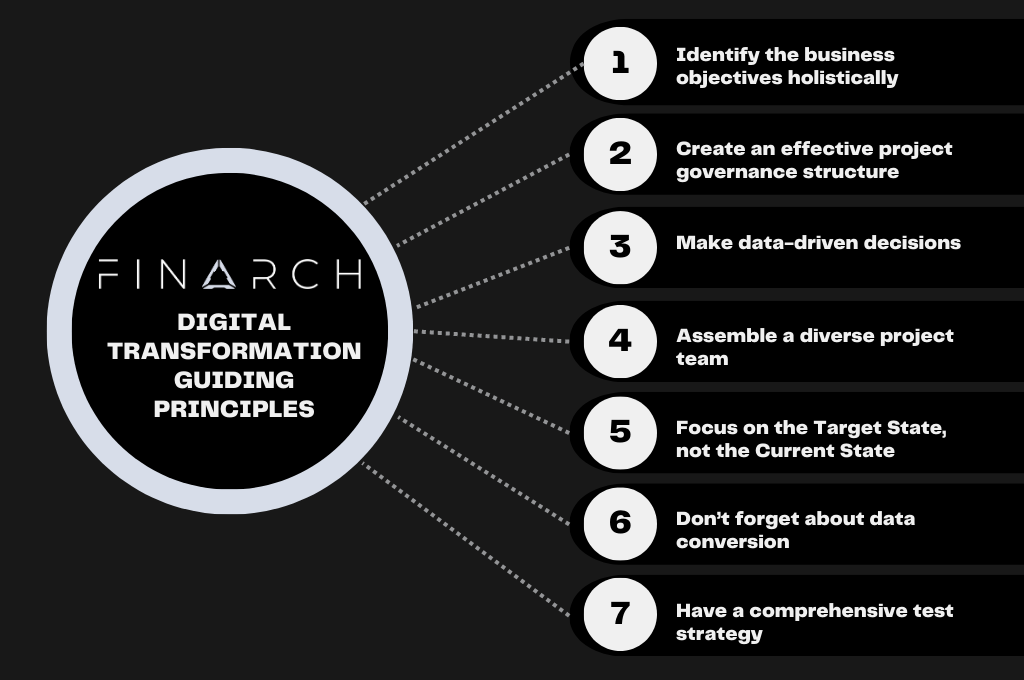

Digital transformation within the capital markets is typically a multi-year journey that requires tenacity, commitment, and agility from all stakeholders. At their core, most investment management transformation projects include the implementation of one or more applications that will replace the legacy systems and processes, which may have been used within the organization for years.