T+1 Regulations and implementation

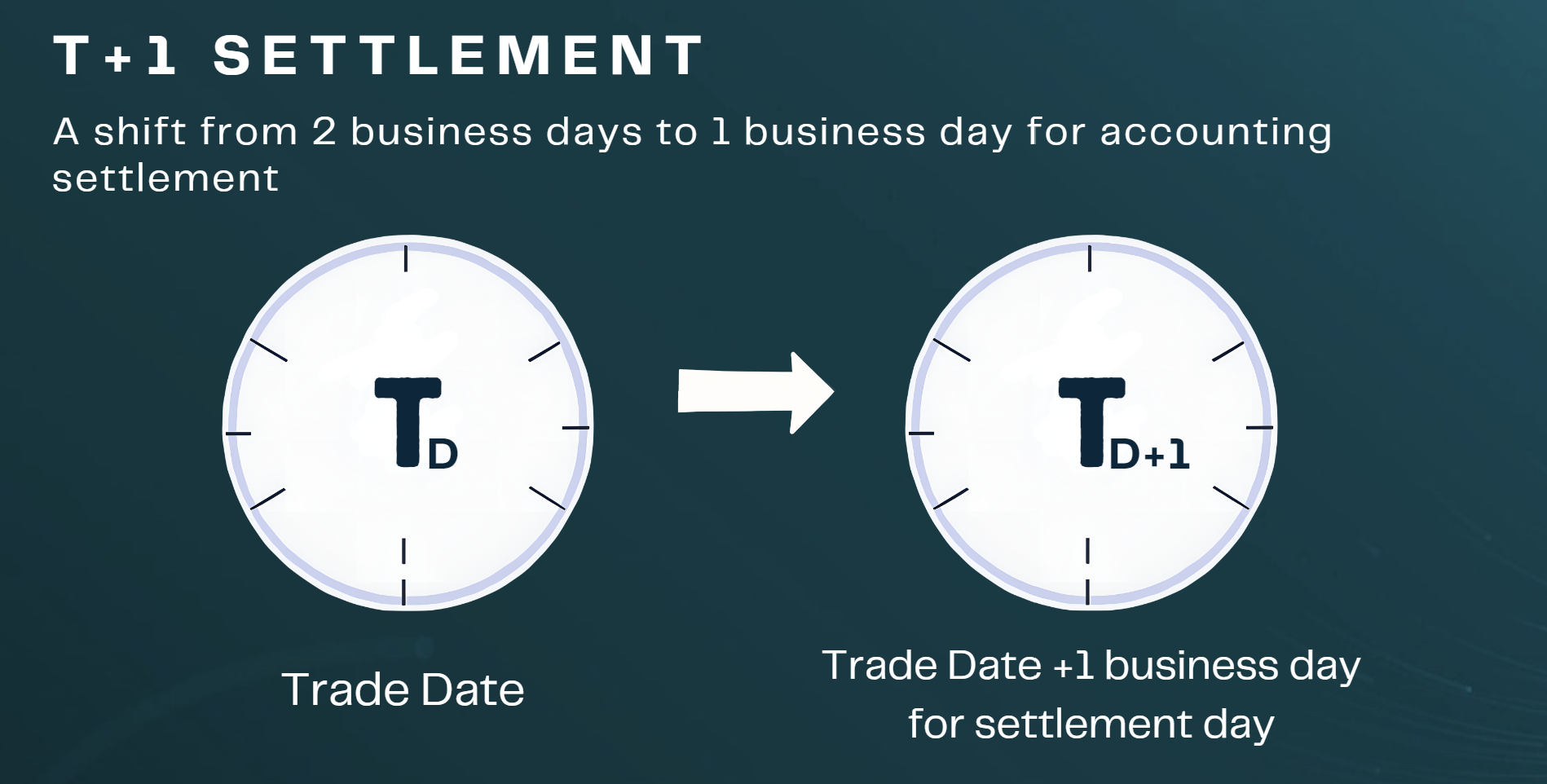

The North American financial system underwent a significant change this past May, with new T+1 trade settlement rules coming into effect. With some exceptions, most transactions in public asset classes were previously required to settle on T+2, that is two days after trade date. This change was primarily spearheaded by the US Securities and Exchange Commission (SEC) with corresponding regulatory bodies in Canada and Mexico, and aims to reduce risk and increase efficiency within capital markets. The reasoning for reducing the settlement window is to reduce the number of opportunities for trades to fail and to free up capital more quickly for investors. This smaller window for settlement has also presented challenges for investment managers and their accounting teams, requiring adjustments to processes and procedures, and in some cases exposed issues with existing technologies (e.g. investment systems) to handle the faster timelines.

Post-Regulation Challenges & Opportunities

Demand for Faster Reconciliation

The speed required for efficient reconciliation to support a one day settlement period is pushing firms’ reconciliation capabilities to their limits

Operational resources under T+2 were aligned to a two-day window to reconcile trades and confirm cash flows. Moving to 1 business day for all settlement and reconciliation activities has compressed the time available for meeting these targets, demanding faster and near-real-time processing, pushing existing reconciliation capabilities to their limits. Re-aligning a firm’s operational processes and human resources to meet these shorter timeframes means accounting teams are facing longer working days, forced errors, and delays.

Investment System Limitations

Over time, technology systems, infrastructure, and organizational processes have been largely aligned to a 2-day settlement environment.

Keeping pace with the new operational and system requirements that T+1 necessitates means that updates to the timing and execution of operational processes and workflows may not have been enough. With most systems and their associated technical architectures having been designed for T+2 settlement and relying on strategically timed batch-oriented processing, assessing and modernizing the technology stack may be worth considering, particularly now that clear issues have emerged – not just theoretical ones. The good news is that it may still be possible to make the necessary system changes without a wholesale re-evaluation of your technology landscape.

Reduced Cash Flow Visibility

Accurate forecasting of multi-currency cash balances are more important than ever, and balancing effective automation with internal workflows and tools are critical to liquidity management.

Before T+1 was introduced, teams had more time to forecast and manage their cash requirements. The time pressure that T+1 adds to the settlement process means that achieving accurate intra-day cash flow tracking is more important than ever, especially for investment managers who trade in multiple currencies. Tracking real-time multi-currency cash balances for today, and accurately forecasting cash balances for tomorrow in time to make the necessary liquidity adjustments, requires robust internal processes and tools, the lack of which are only now being exposed. Investing in the right balance of internal processes, automation, and tools in this liquidity space will ensure that you reduce your risk associated with transaction settlement failures.

Complexity of Global Operations

Firms with global operations also must contend with 24-hour settlement across 24 hours of time zones, creating complexity and workflow challenges.

Firms with global operations used to be able to manage time zone differences across a 48 hour settlement window with relative ease. Ensuring trade confirmation and settlement across time zones now means having additional strategies to bridge the gap between operations teams, time zones, and technologies. For some this has meant staggering workflows or moving tasks to teams in other time zones. For others (particularly European managers) it has meant opting out of trade affirmation processes for trades settling in North America to meet the shortened timing introduced by time zones and increasing their trade settlement risk. Maintaining clear communication channels and access to relevant systems across global teams are critical to ensuring timely settlements.

Borrowing Costs and Liquidity Services

Find the right balance between investments in operational efficiency against the profitability drag generated from borrowing costs when used to manage liquidity needs.

In addition to adjusting internal operational models to meet settlement needs in a T+1 world, there is also a need for firms to have liquidity arrangements in place with banks or other financial institutions to help cover liquidity issues when they arise. These necessarily include additional costs in the form of interest for borrowing funds on short notice, or for setting up additional credit facilities. Reducing borrowing costs by optimizing your internal workflows and tools to prevent having to use credit facilities reduces the ongoing drag of borrowing on organizational costs and profitability.

Conclusion

While the move to T+1 has been generally viewed as a great success from a macro point of view as it has increased market efficiency and reduced risk, at an individual organizational level there have been and there continues to be challenges. The need to reconcile information faster, mitigate current technology limitations, and manage time-sensitive liquidity requirements across the globe, although challenging, also present opportunities for organizations to review, update, and modernize infrastructure and processes.

If these experiences resonate with you or your organization, we are always happy to discuss and further share our expertise in operational modelling and system architecture, and how we might be able to help.