In today’s investment management landscape, frequent updates, enhancements, product lifecycle changes, regulatory requirements and other initiatives all require asset managers to perform regular software testing. Testing within the context of capital markets is oven more onerous, and often require the validation and interpretation of results to be done by Subject Matter Experts (SME) resources, or the actual testing itself.

Our experience indicates that due to demands from Front office/Risk for new capabilities, more data and integration connectivity within the organization, onboarding of additional applications/systems and increasing regulatory demands, organizational system testing efforts are increasing and will continue to do so.

At FINARCH, we think it is critical that organizations begin to explore better ways to perform and manage their testing efforts

It does not matter how modern your technical systems and infrastructure is, as long as organizations continue to rely on manual testing cycles, they will never be able to optimize their release structure and improve system and organizational agility

FINARCH

We suggest organizations build up and use test automation to adapt to the increasing volume and complexity of testing demands. Test automation is a completely different approach and mindset when compared to manual testing. It requires a clear understanding of the current system integration components, a thorough understanding of the processes that are being tested, and knowledge of the different outcomes that can happen. In addition, it requires technical capabilities to build scripts and use new software, and a kaizen-like continuous improvement model to refine the test suite.

Test automation can optimize your organizations release schedule, increase testing accuracy, enhance test coverage to include end-to-end components, and better manage key resource constraints

FINARCH

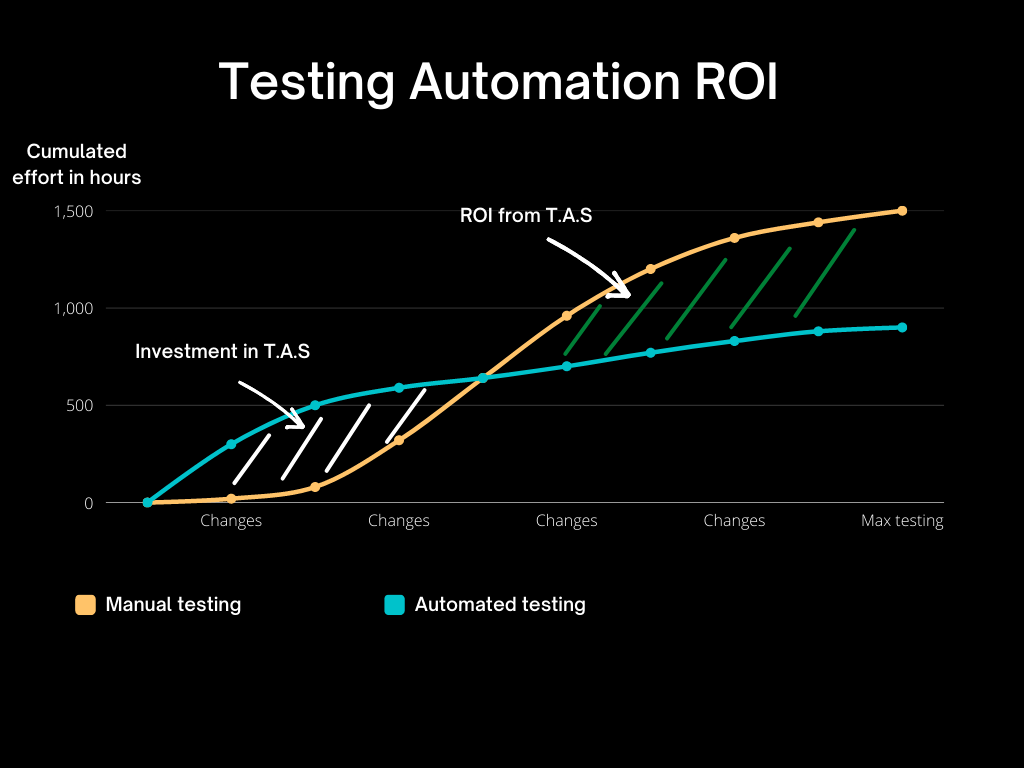

Test automation does come at a cost. As a result, organizations are reluctant to invest in test automation and prefer the safe approach of continuing to use manual testing. The table below indicates the key benefits and challenges organizations face when moving to an automated testing model.

Investing in Test Automation

Test automation is a daunting task for most organizations for the reasons mentioned in the table above. It requires a initial upfront investment, has delivery/project risk, and requires a reorg of the people and processes that make up your existing QA teams.

The decision to invest in test automation should be evaluated like any investment opportunity. From a purely cost perspective, test automation is similar to any capital investment where after the test library is built, the ongoing maintenance cost is minimal when compared to manual testing cycles. More important than pure economics, through investing in test automation organizations can benefit from externalities such as increasing the technical capabilities of staff, and transitioning to a digital and more more agile organization.

Organizations that do invest in test automation provide significant returns on investment, and empower their IT and Operational teams to build technical skills and capabilities

FINARCH

At FINARCH, we are capital markets and investment management system experts. We have the Business/Operational knowledge to quickly understand your operations, and technical know-how to build your test library and get you up and running quickly. Combined with our knowledge of the leading software used in automated testing, we can fast track your automated testing journey so your organization can start realizing a return on its investment.